- Our Offer

- Your investment opportunities

- Plan B & Emigrate

- News

- Panama

- Team

- Contact

Author: Klaus Happ

“Forbes” recommends Panama City as real estate investment

According to Forbes, Panama City is the real estate market on the American continent where an investment will pay off fastest after the Corona crisis. Forbes calls Panama City the best example of a city on the continent that has created its own stable brand. In its report, the magazine analyses foreign real estate as an investment and sees very good opportunities for real estate in Panama.

This is due to the fact that Panama City is the regional headquarters for hundreds of multinational companies and a true business and financial center. As a result, there is a rich and diversified pool of buyers and tenants from all over the world. In addition, Panama’s economy is supported by the Panama Canal, which generates about 40% of Panama’s GDP.

Please find the Forbes report by clicking on the link.

Real estate in Panama is very diverse. No matter if it is a pure capital investment or if you want to emigrate to Panama. The following link provides a good overview.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Podcast about real estate in Panama

In my podcast we talk about the opportunities and risks of real estate in Panama, but also about the economy, the country and its people. Just click on the following link to listen.

The real estate market in Panama is very diverse. No matter whether it is a pure capital investment or a new residence. The following link provides a good overview.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Corona virus in Panama / update 25 April 2020

The corona virus in Panama has not yet overloaded the health system and the new hospital was opened a few days ago after only 28 days of construction. 300 construction workers have been involved and it has cost 6.5 million USD. The rating agency Moodys predicts that Panama will be the richest country in Latin America after Corona from 2021 (purchasing power per capita / more on this below). The goal of the small country is to become a role model in crisis management within the region and to fulfil its role as the “Hub of the Americas” and to further develop this role.

Here you will find the latest information on the Corona Virus in Panama.

Health (figures as at 23 April)

- There are currently 5,166 cases and 146 deaths.

- Doubling of cases every 19 days (Germany 54 days).

- R0 reproduction rate is at 0.95% (similar to Germany).

- Mortality rate is 2.9% (similar to Germany).

- Panama has performed the third most corona tests per capita in the Americas after Canada and Chile.

- The number of intensive care beds should be increased to 25 per 100,000 inhabitants (approx. 45 in Germany).

- There are car “drive-through” test stations.

- Thermal cameras are installed at the metro stations to detect possible fever in people.

- From Panama, the International Red Cross and the United Nations organize their aid deliveries for the other countries of Latin America.

- The logistical importance of Panama as the “Hub of the Americas“, from which Panama profits in “normal” times, has brought disadvantages in Corona times. At the beginning of the corona crisis, many international businessmen and tourists travelled the country and introduced the virus.

Economy

- First Quantum Mining’s Panama Copper Mine has temporarily suspended 7,000 work contracts as the mine was closed due to several corona falls. The mine was opened last year and is expected to represent 3-5% of Panama’s GDP when fully operational (info link).

- The Panama Canal exceeded its revenue forecasts in the 1st half of the fiscal year (Oct-March). The second half of the year will be significantly worse due to weaker world trade. Panama as a maritime services and logistics country offers its shipping customers payment deferrals and discounts on the use of seaports and other services. With the aim of ensuring that they continue to use Panama as a maritime location even in the current crisis.

- The rating agency Moodys leaves Panama’s rating at investment grade Baa1 with stable outlook despite the corona crisis. According to Moodys, Panama benefits from its sustained economic growth, the global importance of the Panama Canal and the country’s logistical location. According to Moodys, these are also the reasons why Panama will be the richest in Latin America from 2021.

- Nevertheless, the slowdown in world trade will have a major negative impact on economic growth in 2020 and lead to a weakening of debt ratios. Panama’s average real gross domestic product (GDP) growth for the years 2010-2019 was 6.2%. Moody’s estimates that the coronavirus pandemic will shrink the Panamanian economy by 1% in 2020.

- The World Bank currently estimates that the GDP of Latin American countries will contract by 4.6% on average in 2020. The economies of Panama (-2%), Colombia (-2%) and Paraguay (-1.2%) would be least affected. Brazil (-5%), Argentina (-5.2%) and Mexico (-6%) would be hit hardest. In 2021, Panama’s economy is expected to grow again at 4.2%.

- Workers employed in the “informal” sector are particularly hard hit by the crisis in Panama. These are “micro self-employed” who work without contracts and insurance. There are many of them.

- On 26 March, a government bond (36 years maturity / triple oversubscribed) was successfully issued and 2.5 billion USD were collected.

Life

- Tocumen airport should be opened to international passenger air traffic from 23 May.

- The curfew will remain in force until May 6 and the first relaxation is expected in 14 days. Currently, it is assumed that the opening of the economy and the curfew will be different in the provinces (federal states), as the above-mentioned health indicators differ.

- Panama was the first country in the region to introduce curfew controls and even separate them by gender (to reduce the number of people on the streets). Peru, Colombia and other countries have followed suit.

- Those who violate measures are threatened with a 3-month driving license suspension and social work (including cleaning buildings and streets).

- The population is very united behind the measures of the government and the situation is calm and peaceful. However, there have also been food thefts and occasional robberies at kiosks.

Main contents of the speech to the nation by the president on 22.04.:

- President Nito Cortizo and his team of advisors are guided by the best practices of other countries that are successful in containing the virus and opening up their economies. Germany is regarded as one of the role models here because of its robust healthcare system.

- He explained that tax revenues are currently falling due to the crisis (minus 42% in March). Private auditors of international repute will join the government team to analyse the country’s spending in connection with this pandemic.

- So far, about half a million food parcels and shopping vouchers have been distributed to vulnerable families.

- President Cortizo was deeply angered that government officials have accepted these aid packages even though they are fully employed. He is giving these workers 48 hours to voluntarily donate 20% of their salary for the next three months, otherwise he will take action against them.

- He also explained that the banking sector in Panama is extremely important because 27,000 Panamanians are employed there and funds are managed for local and international clients. All strategic decisions of the government that affect this sector must be analyzed very carefully.

- The country’s economic advisors have developed a strategic plan to create jobs through public infrastructure projects. These include the fourth bridge over the Panama Canal, the third metro line and the new children’s hospital.

- The President is optimistic that the country’s economic recovery will be sustainable. He has full confidence in Panama’s Minister of Economy and Finance, Héctor Alexander, a veteran politician who played a key role in restoring the country’s economy in the years following the 1989 US invasion.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Corona virus in Panama / update 30 March 2020

The corona virus has arrived in Panama and there are currently 989 cases and 24 deaths (as of 29 March 2020). The Panamanian government has taken strict measures very early in order to control the virus spread. This is to prevent the stress on the health system, which is of course not as stable in a country like Panama as in Germany. Panama has a very young population (average age 26 years / Germany 44 years), which hopefully will help to keep the mortality rate low. The United Nations praised Panama’s measures from the beginning as a model for Latin America (Info-Link).

Here is an overview of the measures:

- Within 30 days a new hospital for corona patients will be built (module construction system, which allows to use it in other places in the future).

- Since 25.March there is a curfew throughout the country. People are only allowed to leave their homes for two hours a day to do their shopping. Who thinks that Panama does not get this organized is wrong. The end number of the identity card of everybody in Panama determines on which two hours a day this has to happen. This automatically avoids overcrowding in supermarkets, pharmacies, etc. and the meeting of many people. Pensioners have their own time of day when they can do their shopping in peace.

- The streets are controlled and non-compliance is sanctioned.

- Exceptions are professionals at the Panama Canal, in banks, in some authorities and of course in hospitals and other security related institutions. Otherwise, work is done via home office.

- All international passenger flights are suspended until 22. April.

- China has donated 5,000 corona tests and other medical equipment to Panama.

- The government is using 2,000 hotel rooms in Panama City (including the Hard Rock Hotel) to isolate corona patients who have tested positive.

- The government distributes 30,000 shopping vouchers to socially weak families worth USD 1.5 million. In addition, thousands of food packages are given away every day.

- Electricity prices are reduced by 30% – 50% and credit payments can be delayed.

Panama has responded very quickly to the new situation, but we have to wait and see how it develops and how the measures work, as is the case all over the world.

The measures taken will have a negative impact on the economy in Panama, as everywhere else in the world. The tourism sector (the main season is fortunately almost over) including the cruise sector and the gastronomy sector are particularly suffering.

The service sector represents about 70% of the Panamanian economy. The main service sectors are logistics, trade, finance and tourism. Thanks to the Panama Canal, the country generates annual revenues between 2 – 2.5 billion USD, which is a lot for a country with 4.2 million inhabitants. Accordingly, great importance is currently attached to the Panama Canal and the seaports functioning as usual, as approximately 6% of world trade flows through the Canal. Currently, many corona supply measures of Latin American countries are organized from Panama (“Hub of the Americas”). The Panama Canal will help to stabilize government revenues. Even if these stable Panama Canal revenues will be lower than normal in the current difficult times. The canal is a windfall for the small country.

The construction sector in Panama is another important component. Currently, construction in Panama is at a standstill due to the corona measures. The “reactivation of the construction sector” with the large infrastructure projects (third metro line, fourth bridge over the Panama Canal, new copper mine) will give Panama’s economy a boost again. Let us hope that we will return to normality in Panama as quickly as possible, as in the whole world.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Reasons for rising property prices in Panama City

We expect real estate prices to rise in Panama City. Since 2016, the real estate market in Panama City has been characterized by a buyer’s market, which allows investors to generate interesting real estate returns. In our article we would like to explain what is currently changing and why we expect rising prices.

In modern city districts, we concentrate on very special locations where hardly any building land is available. These are the Pacific promenades in Panama City with unobstructable views of the sea and the entrance to the Panama Canal. We select the properties according to their micro-location, the quality of construction and rentability. In the UNESCO colonial old town “Casco Viejo” there are basically only about 850 houses on a peninsula, of which about 50% are already renovated or under restoration. Due to the nature of the peninsula, the supply of real estate here is naturally limited. The properties have a great potential for appreciation and we concentrate on details that are in demand (quiet locations, balcony, parking space, etc).

Based on the following points, we expect property prices in Panama City to rise:

- We only buy in the special locations mentioned above, which cannot be expanded due to lack of building land.

- Since 2016, we have had a buyer’s market in Panama City which allows us to buy in prime locations in the modern city at around 2,500 USD per square meter and to rent at around 14-15 USD per square meter. Like every economic cycle, this one will come to an end and we are currently seeing new international investors discovering the real estate market in Panama City, as they can no longer generate interesting real estate returns in their home markets. Here our real estate market report Panama City 2020.

- Due to the worldwide unstable political situation many wealthy families are looking for safe international USD locations. Panama is one of them.

- In the past, political unrest in South America has often led wealthy families to bring their assets to Miami or Panama. Both Spanish speaking, legally secure and with the USD as currency. Whoever wants to invest in the Latin American region will have Panama on the agenda right now due to the lack of alternatives. Under the following link you will find the consequences of the South American crisis for Panama.

- The current crisis in South America is leading Panama to further expand its status as “Hub of the Americas“. More than 250 multinational corporations appreciate the security and geographical location of Panama as headquarters for their Latin American business. In 2019, more new groups have once again set up headquarters than in the previous year.

- Directly in front of the skyline, a city beach (info link) modelled on Rio de Janeiro is to be built, which should greatly enhance the value of the properties.

- Further large infrastructure projects in Panama City will be completed in 2020 (cruise terminal, congress centre, airport terminal) and will bring many new people to Panama. With Metro Line 3 and the new Panama Canal Bridge, new projects will start in 2020 (info link).

- In 2019, one of the world’s largest copper mines started operating in Panama, which will further support the already strong GDP growth.

- Since 2002 Panama has been one of the fastest growing countries in the world economically. It is good to invest where economic growth already exists.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Impact of the South American crisis on Panama

The latest news from South America is disturbing the world. Pictures of serious unrest and partly violent demonstrations dominate the news about Latin America. Of course, I am often asked about the consequences of the South American crisis for Panama.

A Colombian business friend answered this question a few years ago with a visual comparison:

“Panama is like a cork and always floats above, even when the sea gets more turbulent. And never sinks. If the South American economy is doing well, the goods are shipped via the Panama Canal. If the situation is bad, the rich people of South America bring their money to Panama or Miami for security reasons. Both Spanish-speaking and both USD locations.”

Before we come to the current impact of the South American crisis on Panama, let’s take a first look at the crisis hotspots in South America.

The reason for the unrest is usually the great social imbalance paired with a poor education policy and corruption. Often small events are enough to set a process in motion. For example, the price increase of subway tickets by a few cents in Chile.

Some journalists already compare the crisis in South America with the “Arab Spring” many years ago. In contrast to these countries, however, it should be noted that the current South American crisis countries (with the exception of Venezuela) are democratic states.

Here is a brief overview of the current crisis areas in the region:

- The irregularities in the presidential elections in October triggered unrest in Bolivia. As a result, President Evo Morales resigned fled into exile to Mexico.

- In Chile the price increase for subway tickets was the trigger for the protests in October. After weeks of demonstrations, it was agreed to draw up a new constitution. The current crisis is the most serious in the country since the return to democracy in 1990.

- The increase in gasoline prices at the beginning of October led to serious unrest in Ecuador. The protests were so fierce that the government had to withdraw the increase in gasoline prices.

- In Colombia, hundreds of thousands of people went on the streets in November, mostly peacefully against the government. Several people died in the few violent clashes. Here, too, it is a question of calling for more social justice and a better education and social system. The implementation of the 2016 peace treaty with the FARC guerrillas is also on the agenda.

- In Costa Rica, government elections took place in spring 2018, which led to a left slide. After talks with long-term real estate investors in Costa Rica in the last few days, it has become clear that current policy is discouraging investors due to bureaucracy, costs and taxes.

- The big countries Argentina and Brazil are struggling with an economic crisis, debt trap and a failed environmental policy.

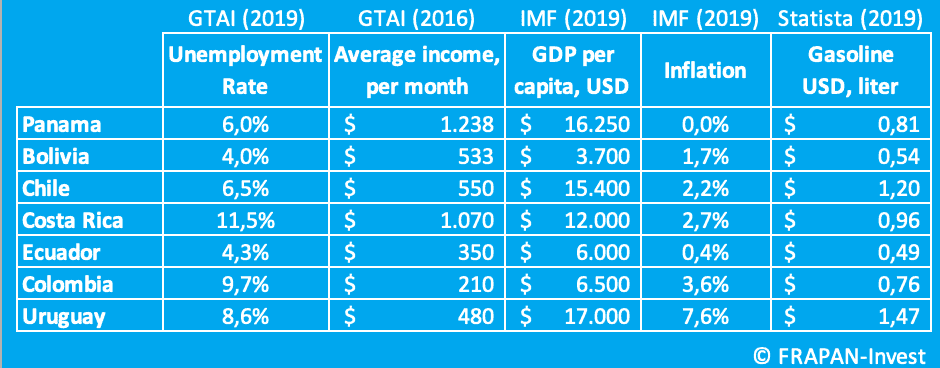

In the current very turbulent times in Latin America, but also in other parts of the world, such as Hong Kong, Panama stands out positively with extraordinary economic growth and a stable political situation. We do not see any violent protests in Panama. As in any other country in the world, Panama, of course, demonstrates peacefully from time to time. Here, too, we are dealing with issues such as education and social policy. And of course there are a lot of things that Panama can improve (Info-Link). However, the average income in Panama is 1,200 USD per month, a multiple of the countries of South America and the GDP per capita is the highest together with Uruguay.

As a USD country, Panama does not have its own central bank and therefore has no possibility to start the money printing machine and generate galloping inflation. The economic growth (IMF estimate 5-6% p.a. for the next 4 years), the USD and legal certainty are the key arguments why most major international companies now have their headquarters for Latin America in Panama City.

There are three major differences to most other Latin American countries, all of which have their origin in the USA:

- The USD as a safe currency since 1904

- The Panama Canal as a safe source of income (Info-Link)

- No military, because the United States protect Panama

Panama serves as a “safe haven” for investors and companies in the USD region. This is unlikely to change due to the current situation in South America. It looks more likely that this will be intensified by the crises in neighbouring countries. Rich people in crisis countries are looking for safe investment locations such as Panama for their capital. And those who want to invest in the Latin American region will probably also have Panama on their agenda right now for lack of alternatives.

As real estate investors, we are noticing this these days, as we are facing increasing international competition when buying real estate in Panama. However, this should have a very positive effect on prices.

Hopefully, issues such as social justice, education and corruption will be addressed throughout Latin America in a sustainable way to improve people’s quality of life.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Panama City Real Estate Market Report 2019 / 2020

Our report about the real estate market in Panama City describes the trends in real estate prices in Panama City in 2019 and gives an outlook for the year 2020. Since the real estate market in Panama City is very diverse, we concentrate in our report on the locations and qualities in which ourselves and our customers are active as buyers. These are the prime locations in Panama City, located in the UNESCO Old Town “Casco Viejo”, in the promenade street “Avenida Balboa” and in Punta Pacifica. These are basically residential properties of very good quality in unique locations.

To understand Panama and the real estate market in particular, it makes sense to use the following link to familiarize yourself with the main events and historical real estate market trends in Panama City. The following real estate prices in Panama City are prices & rents realized by us and/or our customers in the year 2019.

We concentrate on the locations and districts mentioned because they are unique, stable in value and good to rent.

Apartments in the promenade street “Avenida Balboa” are characterized by the breathtaking view of the Pacific Ocean, the islands and the ocean tankers waiting for the entrance to the Panama Canal. They are close to metro stations, workplaces, shopping malls and are therefore popular with the multinational companies in Panama and their employees who are looking for apartments to rent in Panama City. Panama City is the headquarters of 250 multinational corporations. Most of these companies control their activities in Central and South America from here.

We concentrate on the best quality residential towers in relation to construction quality, property management and amenities. The same applies to selected properties in Punta Pacifica. Properties in the prime seaside locations in metropolises are in demand all over the world and will remain so in the future, as the supply is limited.

We are currently seeing a buyer’s market that, with the right strategy, delivers very interesting return figures. While many locations in the world have to struggle with high purchase prices and correspondingly low rental yields, we buy in the first row at the Pacific for approx. 2,300 – 2,500 USD / sqm and rent furnished for approx. 15 USD / sqm in the prime location mentioned above. This enables us to achieve gross rental yields of approx. 7% in USD in the fastest growing country in the western world.

In general, the supply of living space in the modern city has grown strongly in recent years, which has led to falling prices in some locations. As described above, we focus on a specific part of the Panama City property market, where supply is limited and demand good.

In these locations, the prices for buying and renting have not changed significantly since 2018.

Panama City Town Casco Viejo

Directly in front of the skyline of Panama City you will find the UNESCO Old Town “Casco Viejo” (Info Link), where about 850 buildings are listed as UNESCO World Heritage Sites. Many years ago, the Old Town was considered the most dangerous part of Panama City. But with the beginning of the restorations of the beautiful colonial buildings since 2003, the Casco Viejo has successively transformed into a very charming and popular district, in which meanwhile about 50% of the buildings have been restored or are under restoration. As the buildings vary a lot in terms of location, floor plan, quality and equipment, it is much more difficult to name flat purchase prices and rents. In some streets of the old town of Panama City it can be very noisy due to restaurants, renovation work and traffic, whereas in other locations you can enjoy the charm and peace of the old town on your own roof terrace. It depends very much on the right choice of property. Since the number of buildings on the peninsula is naturally limited, it is basically a very unique and stable property location. In our preferred locations and qualities within the old town of Panama City you pay for used real estate approx. 3,000 – 3,500 USD per square meter and rent at 14-18 USD. New restoration projects are much more expensive and usually range between 4,000 – 5,500 USD per square meter.

Ocean Reef Panama City

Outlook for the year 2020

Since July 2019, the new government of Panama has been in office (Info-Link) and here people are waiting for the new projects that promote the economy and bring new workers to Panama. These have a positive influence on the real estate market in Panama through their rental demand. Among the most important major projects are the construction of the fourth bridge over the Panama Canal, on which Metro Line 3 will run and connect the districts on the other side of the canal with the city center. Construction is scheduled to start in 2020. The first cruise terminal and the new exhibition centre in Panama City will also be completed in 2020. Both will lead to a strong increase in foreign visitors to Panama City. The economy will benefit from this and new real estate investors will arrive in Panama City.

And of course the planned beach for Panama City, which would significantly upgrade the attractiveness of the entire city and have a significant impact on real estate prices on the Pacific Promenade (Info-Link).

Panama serves as a “safe haven” for investors and companies in the USD region. The current crisis in the neighboring South American countries reinforces this effect. Rich people in these crisis countries are looking for safe USD investment locations such as Panama for their capital. And those who want to invest in the Latin American region will probably also have Panama on their agenda right now for lack of alternatives. As real estate investors, we are noticing this these days, as we are facing increasing international competition when buying real estate in Panama. However, this should have a very positive effect on prices.

Here is our report “The impact of the South American crisis on Panama“.

In Panama, one of the world’s largest copper mines went into operation in 2019, which will further support the already strong GDP growth. So far, the raw materials sector has had little impact on the Panamanian economy. This will change in the future.

Panama’s population is very young with an average age of 26 years (Germany 44 years) and the population is growing with 2% p.a. (Germany 0.2%). As a result, purchasing power will grow again and the demand for residential properties will increase.

Besides all the positive facts, Panama’s economy continues to struggle with the following difficulties:

- Poor education system of the population

- Reputation as a tax haven although Panama is no longer on the EU or OECD blacklist

- Lack of qualified specialists

According to the IMF, Panama’s economy is growing faster than most of the rest of the world. The economy and government are working to establish Panama as the “Singapore of Latin America“. As the geographical centre of the entire region for business, trade and logistics. These are important elements for the attractiveness of the investment location and the real estate in Panama.

Many of our investors use USD real estate investments in Panama to diversify their assets. Others, however, are also looking for another location outside the euro zone for their lifetime and at the same time apply for a second residence in Panama (Info-Link). Panama and its real estate market have so far been relatively unknown outside the American continent. Due to political developments in many countries around the world, international wealthy investors are increasingly looking for safe new locations.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Beach for Panama City

In recent days, the new mayor of Panama City has presented the 120 million USD plan for Panama City to have its own city beach. Following the example of Rio de Janeiro and Barcelona, a large beach with various other leisure attractions is to be built directly on the city’s promenade over the next few years.

Until the 1960s, the citizens of Panama City had their city beach, which was lost in the following years in the city and population development.

According to the Smithsonian Institute, the plan is feasible since there have been major efforts and projects since 2006 to improve water quality in the Bay of Panama City. The greatest challenge is to continue improving the city’s sanitation situation. Such a prestigious project naturally also offers many opportunities for international companies interested in participating in this project.

On the title photo you can see a visionary picture, how such a city beach could look like and on the following photo how attractive Panama City looks already now.

If this project really is successful, it would significantly upgrade the attractiveness of Panama City as a real estate location.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. Furthermore, Klaus Happ will be happy to advise you personally on the subject of “Plan B in Panama”.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama