- Our Offer

- Your investment opportunities

- Plan B & Emigrate

- News

- Panama

- Team

- Contact

Category: Real Estate

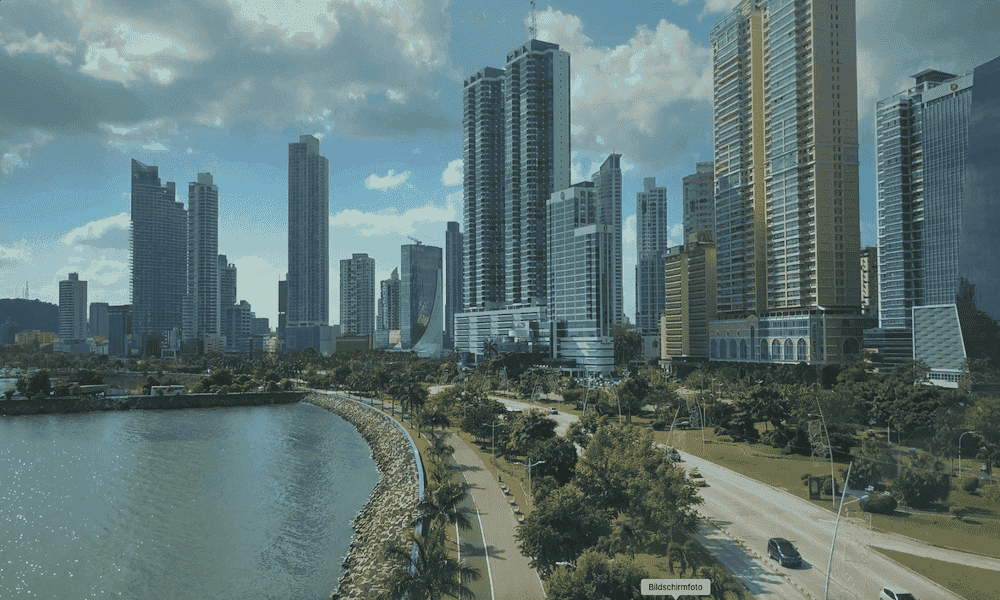

Report about Real Estate in Panama City 2021 / 2022

With our real estate market report Panama City 2021 / 2022 we want to give you an overview of the development of real estate in Panama City and what moves the real estate prices in Panama City. As in previous years, we focus only on the prime locations in Panama City, because we have been active in purchasing and property management here ourselves for years and have the corresponding experience. In addition, we also report on real estate in Coronados beach area.

By clicking on the link you will find our reports about the real estate market in Panama City of the last years.

Let’s start by taking a look at Panama’s economy. Like everywhere else in the world, the Corona crisis has left its impact on the economy and also on the real estate market in Panama. After Panama’s economic growth fell by 17% in 2020, there was a recovery of around 10% in 2021, according to the World Bank. This growth should continue in 2022 with 7.8%. This makes Panama the fastest growing economy in Central and South America in 2021 and 2022, according to the World Bank (info link). The unemployment rate in Panama had skyrocketed to 18% in 2020 and should fall below 10% in 2022, but is still at a high level. Panama’s main source of revenue, the Panama Canal, had another record year in 2021. Revenues were 8.7% above 2020 and even 10% above the pre-Corona year of 2019. Together with Panama’s copper mine, these two sectors in particular have contributed to the stabilisation of Panama’s economy.

From our point of view, the prime locations in Panama City are the old town Casco Viejo, Avenida Balboa, Punta Pacifica and Costa del Este. In addition, of course, the Ocean Reef Islands (photo above), which occupy a special position and on which we will report.

As in the Real Estate Market Report 2020 / 2021, rents in prime locations in Panama City had fallen by 10-15% due to Corona. With the recovery of the economy, the easing of the Corona restrictions and the continued arrival of large multinationals, rental demand in Panama City’s prime locations has increased again and vacancy rates have declined. The largest property management company in Panama City reported vacancy rates in some of its buildings of 15-20% in 2020. This has now dropped to around 5%, it said. Rental bargains in the good buildings are almost non-existent and accordingly rents are moving back towards pre-crisis levels.

Rents have recovered fastest in Costa del Este. Here, the demand for rent is highest due to the many large corporations that often have their headquarters here and their employees. However, there are still many vacant building plots here, which will mean further supply and thus competition for properties in the future. We also see a recovery in rental prices in Avenida Balboa (only 3-4 vacant building plots left) and in Punta Pacifica’s good buildings. Be sure to buy your Panama City flat in the front row on the Pacific, have unobstructed sea views and furnish your flats attractively to stand out from the competition. Today, rental prices in Panama City in the locations and qualities mentioned are around 12 – 14 USD per square metre. The highest rental demand is currently experienced by 2-bedroom apartments, as the second bedroom can also be used as a home office in Corona times.

Choose a good property manager who will take care of your interests in the long term and keep the tenant happy. A good property manager usually charges 10% of the monthly rent. We offer our clients such a property management in Panama City (info link).

A good indicator for an improving rental market is also that many tours of relocation providers in Panama City are currently fully booked. Furthermore, the situation in many other Latin American countries has worsened considerably in recent months. The Corona crisis and left-leaning elections were often the trigger in many countries (Chile, Peru, Colombia, among others). It is currently observed that very wealthy people, e.g. from Peru, are looking for investment and residence in Panama. Both have a positive influence on the real estate market in Panama.

Property prices for residential flats in Panama City in the above-mentioned locations of Avenida Balboa, Punta Pacifica and Costa del Este are still 10 – 15% below the pre-crisis level, depending on location and quality, but have recovered from the interim low prices. Purchase prices here are currently around 2,300 – 2,500 USD per square metre. In Punta Pacifica, some are higher.

The following drone video of Avenida Balboa gives a good impression of the waterfront street in Panama City.

Casco Viejo in Panama City (info link) is a niche within a niche. Panama is a niche in Latin America, and Casco is a niche within Panama City. As a historic UNESCO site, it behaves somewhat differently from a modern city and is more similar to other UNESCO World Heritage Cities. One of the main differences is the limited number of buildings, with around 850 buildings located on a peninsula just in front of the city skyline. For those looking for long-term value, Casco Viejo has always been an interesting market: a walkable neighbourhood by the sea, in an urban setting with many cultural attractions.

Currently, there are new building developments, especially around Plaza Santa Ana. New residential buildings are being restored here, but also commercial areas. In 2021, Panama’s Fashion Week and Panama’s Film Festival (IFF) were held in Santa Ana for the first time. Santa Ana is the less developed part of the old town, where many developers have secured plots and prices are even cheaper than in the already more developed part of the old town of San Felipe. We started construction work on our restoration project at Plaza Santa Ana in September and are looking into new projects with our local partners.

San Felipe is about to enter a new phase. The Sofitel with 159 rooms and the Hyatt with a similar number of rooms will open here in 2022. The old town and its real estate market have always been very dependent on tourism. This came to a standstill due to the Corona crisis and is just now recovering. The planned connecting road between the new cruise terminal and the new exhibition centre into the old town should give the property market in Casco Viejo a new boost. On the residential side, there are also new projects in San Felipe that are moving into the luxury segment. Prices for the new projects range from USD 4,500 – 6,000 per square metre, depending on the location. Good existing properties can be bought for around 3,000 – 3,500 USD per square metre.

If you buy in the old town in Panama City, you should pay attention to the location. The old town can be very noisy due to street noise and bars. Parking spaces are in short supply. Furthermore, when buying existing real estate, you should make a very careful technical inspection of the construction quality. After all, we are talking about old properties in an old town. Prices and rents have come down due to the Corona crisis, which had risen constantly in previous years. If one believes in the advantages of such a UNSECO old town with naturally limited inventory, you should find very interesting investment opportunities here in the long term.

Ocean Reef Islands (info link) takes a special position due to its exceptional location, quality and prices. You will probably not find a comparable project in all of Latin America. On Island 2, the construction development is progressing very well and the sale of the flats in the different apartment buildings is much faster than expected. These are international buyers and often investors are buying for the second time on Ocean Reef because they are satisfied with their inventory. We have assisted various investors with their purchases in different projects on Ocean Reef. Sales prices have steadily increased over the last two years and are currently around USD 6,000 per square metre. Since there are not many available building plots left and no more islands may be built, prices should probably continue to rise due to the limited supply. Please feel free to contact us if you are interested.

Properties in Coronado or the beach area of Coronado (Info – Link) are still popular. Due to the closeness to Panama City and the good infrastructure, the area is a popular destination for tenants, tourists and buyers. However, due to the Corona crisis, rental demand from foreign tourists has dropped sharply, which often represented a larger part of the income. This is also recovering in the current tourist season, but is far from being back to pre-crisis levels. The majority of tenants currently come from Panama City and spend their weekends or parts of their annual holidays here. The advantage is that AirBnB rentals are allowed here, unlike in Panama City, which allows you to use the property partly yourself while it produces additional income. With significantly more effort (short-term rental), one can achieve similar rental income as with a comparable long-term rental in Panama City. Long-term rentals are more difficult in Coronado. The purchase prices in the best residential areas have fallen by approx. 10-20% compared to the pre-Corona level due to the crisis. Here you can currently find very attractive offers for approx. 2,000 – 2,200 USD per square meter.

In general, a recovering tourism sector is positive for the entire real estate market in Panama. Both for holiday rentals and for the buyer’s market. In the past, many tourists got to know the uniqueness of Panama during their holidays and were then interested in buying real estate. A few weeks ago the new cruise terminal as well as the new convention centre opened in Panama City and brought new people to Panama. Let’s hope that this development continues.

In August 2021, the popular Friendly Nations visa was changed. Until then, it was possible to obtain a second residence in Panama with little financial effort and a few documents. Now, an investment of at least USD 200,000 is required to obtain a residence permit in Panama. What impact does this have on real estate prices in Panama? With the old regulation a large number of foreigners had been given the opportunity to settle in Panama. Most of them will not have made major investments in Panama and will not live in Panama constantly. Some of them will have stimulated the rental market and possibly bought a property later. The new regulation attracts a much smaller number of foreigners who are able to apply for residence in Panama. However, they directly invest at least USD 200,000 in the real estate market in Panama. Which variant will have the better impact on real estate prices in Panama is difficult to say at the moment. In addition to the investor visa, there is still the pensioner visa in Panama (overview of visa types).

While in most parts of the world you find an overheated and very expensive real estate market, in Panama you can still buy property at a reasonable price if you compare the purchase price with the rental income. With rents currently in a recovery phase, purchase prices should probably follow the rising rents. This has happened before in 2020 / 2021 when rents started to fall (info link to Prices follow rents).

We are happy to help you find your suitable property in Panama.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. He offers advice on all aspects of living in Panama.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Interview about real estate in Panama City

Klaus Happ speaks in this interview about the current condition of the real estate market in Panama City and the opportunity it offers. He is interviewed by Anthony Robinson from YK Law. Just click on the video BELOW to learn more.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. He offers advice on all aspects of living in Panama.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Where to buy real estate in Panama City?

What are the most interesting districts in Panama City? What are the real estate prices in Panama? Klaus Happ reports in his video about the three most interesting neighborhoods in Panama City. These are the old town Casco Viejo, the modern neighborhoods at the Pacific Promenade and the Ocean Reef Islands. Just click on the video BELOW to learn more.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. He offers advice on all aspects of living in Panama.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

Real estate: Prices follow rents

Property prices in Panama City have declined slightly in some districts in recent months, following the trend in rents. With this report we would like to give a short update to our detailed “Real Estate Market Report Panama City 2020 / 2021“.

We exclusively report on high quality properties in prime locations in Panama City, located in the UNESCO Old Town “Casco Viejo”, in the promenade street “Avenida Balboa”, in Punta Pacifica and on Ocean Reef.

With the beginning of the Corona crisis in Panama, the government announced a hard lockdown in March 2020, which was then gradually relaxed from June 2020 and ended in October 2020 with the reopening of the international airport. The aim was to protect the health of the population. But this ultimately led to a hard shutdown of economic activity and a decline in government and private revenues. According to current estimates, Panama’s economy will grow by +9,9% in 2021, but it will take time to make up for the negative GDP growth of -17% in 2020.

Meanwhile, the government is taking a more business-friendly Corona course (Corona update 26 March 2021), but keeping an eye on the health aspects.

During the hard lockdown in 2020, many expats from the large multinationals had temporarily returned to their home countries and property viewings were very difficult due to the exit restrictions. Some property owners also rented at much lower prices than before to generate income. This, combined with smaller budgets due to the tight economy, led to 10-15% lower rents for new rentals.

While in 2020 most owners were not willing to sell at lower prices than before, this has gradually changed in recent months. On Avenida Balboa we see that purchase prices have followed rental prices. Buyers have been able to realise prices about 10-15% lower than before the Corona crisis. The best locations and qualities on Avenida Balboa can therefore currently be bought for between USD 2,000 – 2,500 per sqm and rental yields of approx. 7% p.a. can therefore be achieved again. With the advantage that one can take advantage of lower entry prices and the favourable Euro / USD exchange rate. The decline in prices is also related to the fact that in June 2021 the credit moratorium (as Corona aid) will expire and then loans will have to be paid again, which could put some people under pressure. It should be taken into account here that the credit share is not particularly high.

In the meantime, it seems, rents have found a bottom and are picking up again. This is probably also due to the fact that the rental bargains of unsettled owners have now been absorbed by the market. This should, in consequence, also lead to rising purchase prices again.

Ocean Reef Islands

The price drop mentioned was not observed in our preferred locations in Punta Pacifica. The price decline does not apply to the two artificial islands Ocean Reef either, because here the demand has rather increased due to the Corona crisis. This is due to the special island location and the fact that the very tense economic and social situation in some other Latin American countries is causing very wealthy people from these countries to look for new locations, such as Panama City.

Furthermore, 2-bedroom appartments remain attractive, as it is very convenient to integrate a home office.

The increased demand for beach appartments near Panama City continues (info link).

Casco Viejo Panama

In the UNESCO old town “Casco Viejo” (info link), the purchase prices have remained at about the same level as before Corona and renovation work is in full swing. Unfortunately, many shops and hotels that live off tourism are still closed. Basically, Casco Viejo is a very unique and stable value real estate location, as the approx. 850 buildings on the peninsula in front of the skyline cannot be duplicated.

We are happy to help with our experience in negotiating the purchase price in the current dynamic and exciting market environment.

The real estate market in Panama is internationally one of the most interesting locations for real estate investments and we would like to be your local representative and take care of your real estate in Panama on a sustainable basis.

Profitable, safe and beautiful:

Investments in Panama

Panama City Real Estate Market Report 2020 / 2021

Our report on the real estate market in Panama City 2020 / 2021 describes the trend of the real estate market in the exceptional Corona year 2020 and takes a look at Panama’s real estate in 2021. As in the previous year (Report 2019 / 2020) we only report about high quality real estate in prime locations in Panama City, which are located in the UNESCO Old Town “Casco Viejo”, in the promenade street “Avenida Balboa”, in Punta Pacifica and on Ocean Reef. Because these are the locations in which we are active ourselves and can report on prices & rents realized by us.

Those who wish can use the following link to learn about the main events and the historical real estate market trends in Panama City over the last decades.

Anyone who has ever been to Panama City will have noticed that the skyline and thus the supply of residential real estate is huge. That is why we have always focused on unique, hard to duplicate locations with good quality. These are stable in value and easy to let.

The year 2020 had started very well for the real estate market and the economy of Panama. The new Panamanian government had only been in office for six months and new major projects were in the starting blocks (including the city beach Panama City, the fourth bridge over the Panama Canal, the third metro line, and the new cruise ship terminal). In addition, Panama’s copper mine had just gone into operation and the old town “Casco Viejo” was full of large groups of tourists.

And then the corona virus came to Panama…and everything was stopped.

The Panamanian government took a strict course against the virus from the beginning and implemented a hard lockdown of the country from mid-March on. This lockdown was gradually relaxed from mid-June and finally ended on October 12th with the opening of the international airport and tourism.

- Due to the month-long lockdown, which also applied to the real estate industry, there were hardly any sales during this period that could be used to determine a trend for prices.

- Since the beginning of October, furniture stores have been well visited again and many are sold out. Confidence is back.

- However, the Corona-related higher unemployment in Panama will probably affect prices and rents of C and D properties (lower quality locations).

- B properties (medium to good locations & qualities) have proven to be quite crisis resistant in terms of both prices and rents.

- Prices in prime locations in Panama City are at about the same level as before. Owners are not willing to sell at really lower prices. Of course, there are always exceptions, but a trend cannot be seen.

- At the same time, the Corona credit moratorium was recently extended until June 2021, which is why credit-financed real estate is not under stress. In general, the credit share of real estate in Panama is quite low, which makes it less vulnerable to crises.

- Many expats (employees of multinational companies / tenants for A-locations) had temporarily returned to their home countries during the Panama lockdown. During the lockdown it was difficult to find new tenants and to arrange viewings. Therefore, rents for new leases for A-locations have fallen 10-15%. Expats have been returning to Panama since the reopening of the airport in October, which is again supporting rental demand and is already noticeable.

- Since October we have also been seeing international buyers in Panama again. These come from Europe and we ourselves are seeing, for example, increased demand from German-speaking Europe for applying for second residences in Panama and opening bank accounts.

- In addition, our real estate partners in Panama are reporting increased interest since the reopening of the airport from wealthy people from South America (including Argentina, Chile and Colombia) who, due to various crises in their home countries (often accelerated by the Corona crisis), consider USD real estate in Panama as a “safe haven”. The Bloomberg report (info link) published a few months ago, which reports on the escapes of millionaires from the countries of South America to Panama and other interesting locations, also fits in with this.

- Panama is regionally in a very good position for a strong recovery in 2021. The recovery will be slow, but has already begun. And as long as Panama remains a stable and safe country due to its international importance, this recovery is likely to occur much faster than in other parts of Latin America

- The above mentioned mega infrastructure projects will bring new labor force and thus rental demand to Panama.

- We continue to buy real estate in Panama City in a prime location in the first row by the sea at approx. 2,300 – 2,500 USD / sqm and rent it out furnished in Corona times at approx. 12 – 14 USD / sqm (previously 14 – 15 USD). If the rental market remains at the lower level for a longer period of time, purchase prices will probably also be adjusted accordingly.

- The purchase of smaller apartments (40-70 sqm) in A-locations can be interesting in times of crisis, because the rental budgets are in general smaller. These are also available in buildings with CoWorking areas (Offer-Link).

- At the same time 2-bedroom apartments keep their attractiveness, because you can integrate your home office very easily.

- An increased demand is currently experienced by beach apartments near Panama City, because you can also work from there in your home office (info link).

However, Corona also offers opportunities.

With the island project “Ocean Reef” (info-link) they offer buyers among other things guaranteed USD rental income of 6% annually after costs. Even during the Corona Lockdown, many properties were bought here even before construction began, since people feel more relaxed on the islands than in the city center. “Ocean Reef” is the most successful real estate project in Panama City. The quality and location of this island property is unique in Latin America, as it is located directly in front of the center of Panama City, but due to the island location, one can enjoy its tranquility.

Also in the UNESCO old town “Casco Viejo” (Info Link) the purchase prices remained approximately on the level before Corona. For used properties in good locations you pay about 3.000 – 3.500 USD per square meter. The renovation works in the old town are running at full capacity again and new beautifully restored colonial buildings are being built. However, many stores and hotels that depend on tourism are still closed and this affects the attractiveness of the old town. Nevertheless, the Corona pandemic has also brought an advantage here. Because in the old town, whose narrow streets are often congested with cars, certain streets are now closed off at set times so that restaurants can use the beautiful streets for their tables.

Basically, the Casco Viejo is a very unique and stable value real estate location, since the approximately 850 buildings on the peninsula in front of the skyline cannot be duplicated.

The plan for an city beach in Panama City, which was initiated last year and would have significantly increased the attractiveness of the entire city, is not being realized at the moment. Instead, a viaduct bridge road will be built to connect the promenade road of Panama City with the Causeway (Pacific Island Road in front of the city).

Panama serves as a “safe USD haven” for investors and companies in Central and South America. Current crisis in the neighboring South American countries reinforce this effect. Exactly for such wealthy investors from South America, Panama has created a new investor visa, which promotes foreign direct investments in Panama and at the same time grants a residence permit under certain conditions. Whoever wants to invest in the region of Latin America will not be able to ignore the Panama location in his considerations right now.

As in the past, Panama’s objective is therefore to emerge from the crisis better than its neighbors and to remain the more attractive and safer country for investors.

And in times when there are political and regulatory developments in Europe and the USA that do not appeal to every investor, Panama will continue to be an attractive location for asset diversification. We are also happy to assist you in applying for a second residence in Panama (info link).

Property prices in Panama City (A-locations) have historically often followed the trends in the USA (e.g. Miami) and these have risen strongly this year. During the Panama-Lockdown this was not possible, so there is a certain need to catch up.

Although the purchase prices for 1A real estate in Panama City are roughly at pre-Corona level, I advise every buyer to negotiate the seller’s price nevertheless. If you don’t need a loan, but can pay directly with equity, you have a very good basis for negotiation. We are happy to help with our experience in this context.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. He offers advice on all aspects of living in Panama.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

6% guaranteed USD rental income on Ocean Reef

The Ocean Reef real estate project in Panama City was the most successful real estate project in Panama even before the Corona crisis. Currently, buyers on the islands are offered, among other things, guaranteed USD rental income in Panama of 6% p.a. net. One of our clients has bought the beautiful penthouse and only a few apartments are still available.

The corona situation in Panama has now caused real estate buyers and tenants to become more interested in the islands near the city in recent weeks, as they feel more comfortable here than in the city center. After the USD has lost 10% in value against the Euro, luxury apartments can be bought for around 630,000 Euros.

Current offers (from the developer; not binding)

6% Interest on down payments

6% p.a. guaranteed net rental income

for the first two years (three years in some cases)

Here you can find more about the Ocean Reef Islands in Panama City (link).

If you are interested, I will gladly send you the price list and further information.

With the help of the German company Bauer the two artificial islands “Ocean Reef” were created, which are connected to Panama City by a private road. The two islands are connected by a marina with 170 jetties, the first 40 of which were inaugurated in January 2020.

According to the law, from now on it is no longer possible in Panama to create more artificial islands for private use or resale. This makes Ocean Reef unique!

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. He offers advice on all aspects of living in Panama.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

“BaseCamp” plans to develop a technology park in Panama

The prominent Israeli company “BaseCamp” will develop a technology and innovation park in Panama. The goal is to make Panama a digital hub in Latin America. This will involve attracting technology companies from around the world, building start-ups and improving education in Panama.

By clicking on the link you can access the report.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. He offers advice on all aspects of living in Panama.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama

“Forbes” recommends Panama City as real estate investment

According to Forbes, Panama City is the real estate market on the American continent where an investment will pay off fastest after the Corona crisis. Forbes calls Panama City the best example of a city on the continent that has created its own stable brand. In its report, the magazine analyses foreign real estate as an investment and sees very good opportunities for real estate in Panama.

This is due to the fact that Panama City is the regional headquarters for hundreds of multinational companies and a true business and financial center. As a result, there is a rich and diversified pool of buyers and tenants from all over the world. In addition, Panama’s economy is supported by the Panama Canal, which generates about 40% of Panama’s GDP.

Please find the Forbes report by clicking on the link.

Real estate in Panama is very diverse. No matter if it is a pure capital investment or if you want to emigrate to Panama. The following link provides a good overview.

FRAPAN-Invest

Klaus Happ’s company “FRAPAN-Invest” advises investors who want to invest in real estate in Panama. He offers advice on all aspects of living in Panama.

The real estate market in Panama is internationally one of the most interesting for investments. We would like to be your trusted local partner and assist you with the initial purchase. Additionally, we can take care of your real estate in Panama in a sustainable way.

Profitable, safe and beautiful:

Investments in Panama